DAYS

HOURS

MINUTES

SECONDS

ESTATE PLANNING Trusts or Wills, why does it matter... Avoid Probate!

READY FOR THE eSTATEPLAN

Schedule your Family Legacy Plan with Financial Concierges that will guide you through the process of working with our team of attorneys, insurance agents and coordinating your design for your TRUST.

Please allot 60-Minutes uninterrupted for this interview. It is highly recommended that you attend a virtual or live session; prior to scheduling this interview.

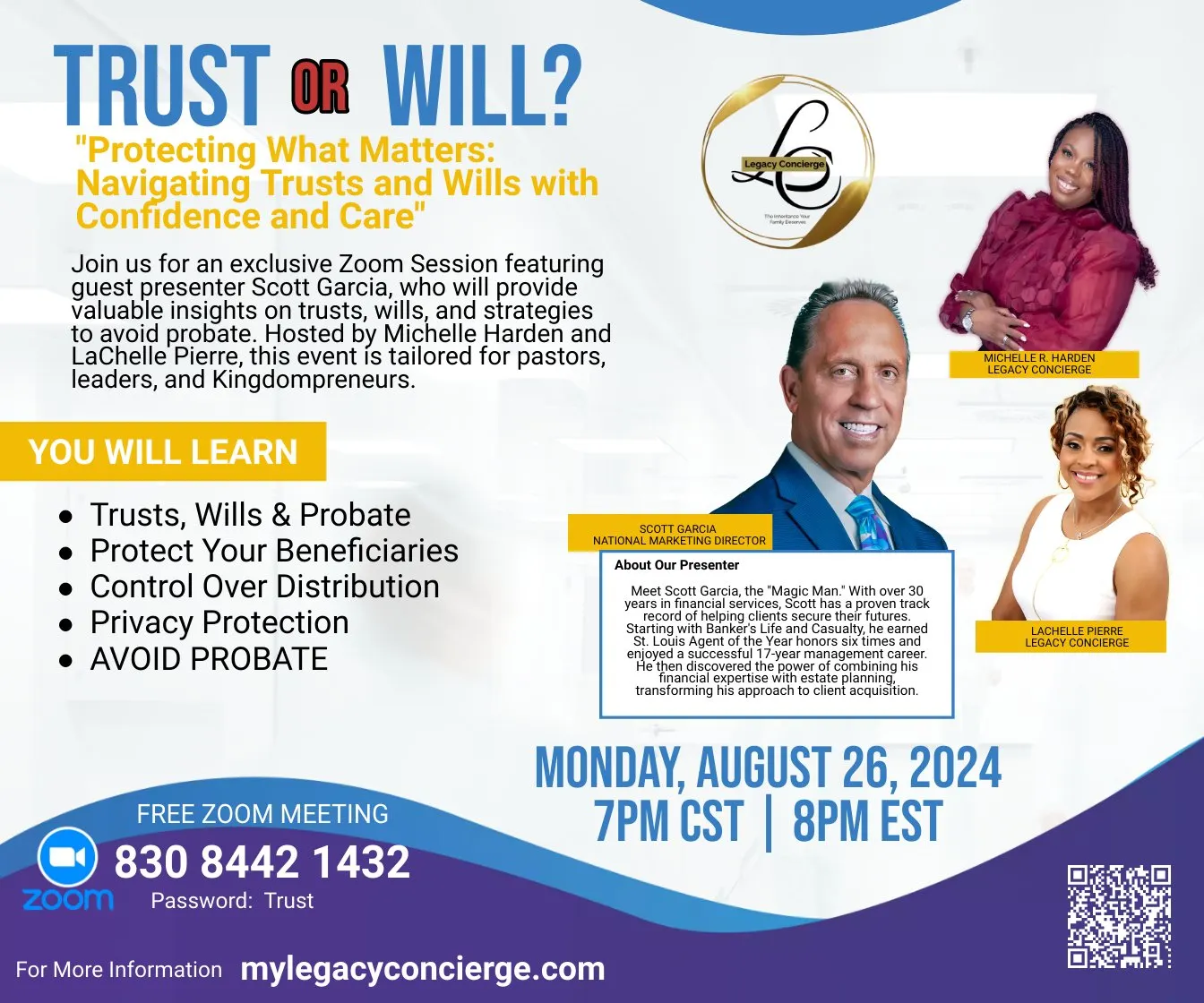

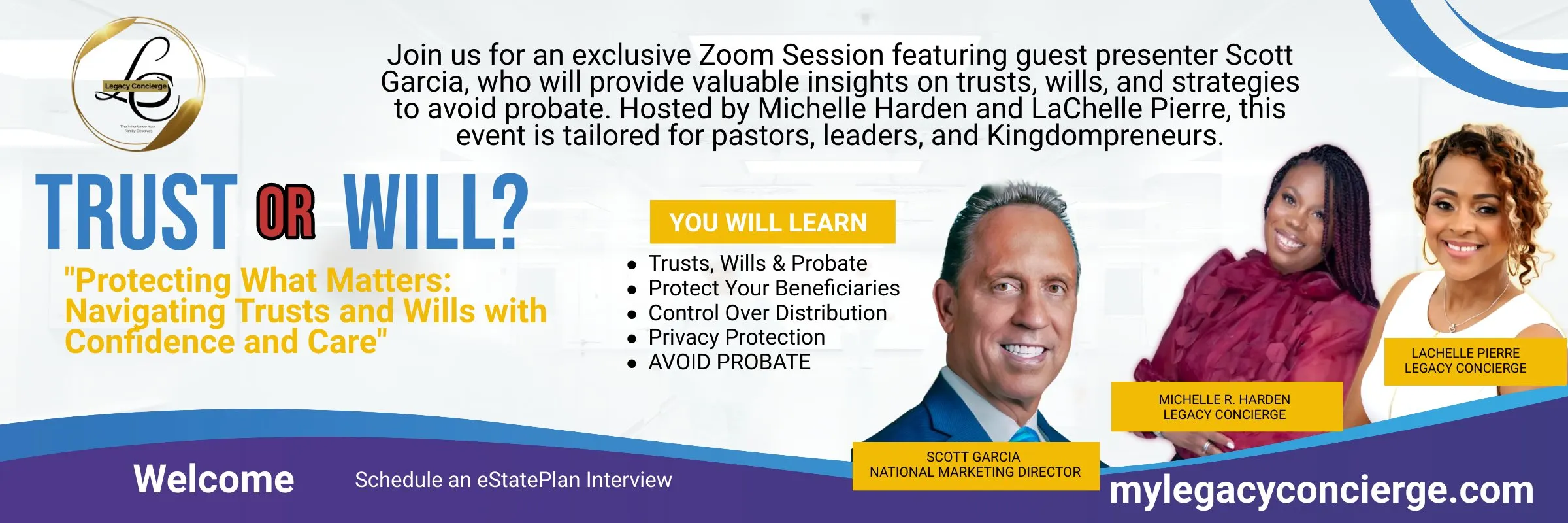

VIRTUAL SEMINAR!!

Monday, August 26, 2024 7:00PM CST

Register for this FREE limited-time offer and learn insider secrets on eStatePlans.

Why this TRUST see the benefits

It's an eStatePlan that utilizes the trust as the vehicle to hold all of your personal/business assets:

Benefits

One-Time Set Fee

Unlimited Updates

Client can make changes online

Medical Card

The "A" Team: Attorneys, Agents and Administrators

WHO IS THIS TRAINING FOR?

-

Trust seminars are intended to share information about trusts, wills and how to avoid probate. More importantly, how to be proactive in ensuring your family has access to your harmonious legacy.

Pastors, Clergy and Churches: The community we find most importantly to share trusts seminars. Pastors touch a broader audience and service many funeral that are unexpected deaths, unplanned financially (without insurance) and family disputes. In addition, Pastors are the "keyman" to the ministry with possibly their own personal family interest exposed.

Entrepreneurs and Small Business Owners: Building trust is crucial for business growth, so entrepreneurs can benefit from strategies to establish credibility and trust with clients and partners.

Financial Advisors and Estate Planners: Professionals who handle financial matters and estate planning can learn about the importance of trust in managing client relationships and advising on trusts.

Legal Professionals: Lawyers and legal professionals dealing with trusts and estates can gain deeper insights into the nuances of trust law and best practices for client communication.

Nonprofit Leaders and Volunteers: Trust is crucial for nonprofits in building relationships with donors, volunteers, and the community.

Educators and Academic Professionals: Trust plays a role in student-teacher relationships and institutional integrity, so educators might find these seminars useful.Legal Professionals: Lawyers and legal professionals dealing with trusts and estates can gain deeper insights into the nuances of trust law and best practices for client communication.

WHO IS THIS TRAINING NOT FOR?

-

Someone who is not interested in learning about trust or in ensuring that their family is left with a secure and harmonious legacy, both financially and emotionally.

Here's What You'll Learn From These Giants:

-

Avoid Probate: A trust allows your assets to pass directly to your beneficiaries without going through the lengthy and often costly probate process, saving time and money.

-

Privacy Protection: Unlike a will, which becomes a public record, a trust maintains privacy by keeping the details of your estate out of the public eye.

-

Control Over Distribution: A trust provides you with the ability to specify how and when your assets are distributed to your beneficiaries, ensuring that your wishes are honored even after you're gone.

-

Protection for Beneficiaries: A trust can offer protection for beneficiaries who may not be financially responsible or are minors, by setting conditions or providing for gradual distribution.

-

Estate Tax Benefits: Certain types of trusts can help reduce or eliminate estate taxes, allowing more of your assets to be passed on to your heirs rather than being consumed by taxes.

-

eStatePlan: How to simplify a daunting process with easy that allows you to upload special message and memories for eternal access by your loved ones.

Our Concierges Process

At Legacy Concierge pride ourselves on providing exceptional service through a team of highly skilled and licensed insurance agents. Our primary goal is to ensure that you have a seamless and informative experience as you embark on the journey to complete your eStatePlan.

Our experienced Concierges are dedicated to guiding you through every step of the eStatePlan interview process. During this initial phase, our team will conduct a thorough and personalized interview to understand your unique needs and goals. This critical conversation is designed to gather essential information and offer you a comprehensive overview of how our online portal can be utilized to its fullest potential. We are committed to making this process as smooth and straightforward as possible, ensuring that you feel confident and well-informed.

Once your interview is complete, and you have successfully onboarded, you will be introduced to an exceptional group of professionals who will support you throughout the remainder of your eStatePlan journey. This distinguished team includes top-tier attorneys, seasoned financial consultants, and industry experts, each of whom brings a wealth of knowledge and experience to the table. Their collective expertise will be instrumental in helping you navigate the complexities of estate planning and ensuring that all aspects of your plan are meticulously crafted to meet your specific needs.

Our attorneys will work closely with you to provide legal guidance and ensure that your estate plan complies with all relevant laws and regulations. Their role is crucial in drafting and finalizing the legal documents that will form the foundation of your estate plan. They will address any legal concerns you may have and ensure that your wishes are accurately reflected in your plan.

In addition, our financial consultants will offer valuable insights and advice on managing your assets and investments. Their expertise will help you make informed decisions about how to best structure your estate to achieve your financial goals and minimize tax liabilities. They will collaborate with you to develop strategies that align with your long-term objectives and provide peace of mind regarding your financial future.

Throughout this process, our experts will be available to answer any questions you may have and provide support as needed. They will work together to ensure that all elements of your eStatePlan are integrated seamlessly and that your plan is tailored to your unique situation.

Legacy Concierge, we understand that estate planning can be a complex and emotionally charged process. That is why we are committed to offering personalized service and expert guidance at every stage. Our team is here to make sure that you receive the highest level of support and that your eStatePlan is completed with the utmost care and attention to detail.

We look forward to working with you and helping you achieve your estate planning goals. Should you have any questions or need further assistance, please do not hesitate to reach out to our team. Your satisfaction and peace of mind are our top priorities, and we are here to ensure that your experience with us is both positive and rewarding.

Join Our Team of Insurance Professionals

This growing industry wants YOU!

Our clients that secures their eStatePlans need additional Financial Advise regarding retirement, 401k plans, annuities and converting terms to IUL/Whole Life Policies. Who better to guide them than a licensed Insurance Agent.

Join our team, training and mentorship provided. You can ask be an eStatePlan Adviser without being a licensed insurance agent.

2024© All rights reserved. Developed by ASKTHEBRANDMASTER